HTN | Weekly Health Tech Reads | 3/3

This week's newsletter sponsored by: SidebarBeing a senior leader in healthcare can be lonely. Growing your career in this space requires making a lot of tradeoffs and placing bets on what you believe will have the most impact, then doubling or tripling down on that. As a result, it can be challenging to find time to grow a network of supportive peers. Sidebar is here to help change that. Their vetting process and matching engine pair you with a small group of supportive peers to lean on for unbiased opinions, new perspectives, and honest feedback. Sidebar provides the platform, curriculum, and facilitation–all you need to do is take a few minutes to apply.

If you're interested in sponsoring the newsletter, let us know here.

News

|

agilon expects that over the next 12 - 24 months, payors will adjust their bids and plan designs to recapture margin, while CMS will need to reset benchmarks to account for the rising medical cost trend. It is certainly going to be interesting to watch how agilon seeks to navigate through this period and retain confidence in its model. Look no further than the analyst question about whether agilon has considered moving away from capitation contracts given market dynamics. That question feels like a huge shift from the tone of the market in years past. agilon shared it is not intending on moving away from capitation. Rather, it is focused on renegotiating contracts with payors in two ways - one, receiving a higher percent of premium, and two, carving out things out of agilon’s control. agilon specifically referenced supplemental benefits, Star rating scores that agilon doesn’t control, and aggressive bids by payors as things that it is renegotiating. They said it’s too early to tell if payors will be open to these changes, although they’re optimistic and think payors see the value in having a PCP partner like agilon. It goes without saying these negotiations will be critical to agilon’s ability to right the ship moving forward.

Links:

- agilon Q4 2023 Earnings Transcript

- agilon Q4 203 Earnings Presentation

- agilon Q4 2023 Earnings Release

News

Astrana Health highlights its growth opportunity in moving to full risk capitation arrangements

Summary:

Astrana (formerly ApolloMed) posted a solid quarter and reiterated its expansion plans, mentioning its plans to grow into 1 or 2 markets a year with a planned entry cost of $5 million to $10 million per market. It has already entered two new markets outside of California - Nevada and Texas - and noted on the earnings call that it expects Nevada to be run-rate breakeven by the end of 2024.

Astrana seems like it is zigging while its public peers are zagging at the moment. While you’ve got Privia aggressively moving away from capitation, and agilon cautioning about the dislocation in the market for the next 12 - 24 months, Astrana appears to be going full steam ahead attempting to move to full risk capitation contracts with its payor partners. The recent partnership with BASS Medical Group came up during the call, with Astrana noting it will be providing a suite of VBC-related services so that BASS can succeed in a value-based care contract over time. Astrana noted that this full-risk business is separate from what BASS has been using Privia for (Privia noted on its earnings call that its relationship with BASS hasn’t changed).

There was also some interesting, very nerdy, dialogue in the earnings call about a Restricted Knox Keene license approval and how members are moved to full risk over time. An analyst was confused about why the percentage of capitation revenue in full risk deals grew from only 46% of revenue to 49% of revenue, which led to a conversation about how the California Department of Managed Health approves contracts for full-risk.

Links:

News

Hims & Hers stocks jumps 30%+ on profitable growth in Q4

Summary:

Hims reported that revenue for 2023 jumped 65% yoy to $872 million on 48% subscriber growth. It also posted its first quarter of positive net income in Q4, squeaking by with $1.2 million in net income for the quarter. Hims is focusing on five core specialties, all of which it believes have the opportunity to be $100 million lines of business moving forward: sexual health, men’s dermatology, women’s dermatology, mental health, and weight loss. It expects weight loss to be an $100 million business in 2025, just a year after launching.

The chart below from the shareholder letter (linked below) is particularly interesting. It is quite impressive how quickly Hims & Hers has been able to take share from key competitors.

Hims & Hers seems to think it’s MedMatch tool, which enables personalized treatment options is a key driver here for the business and spent a good deal of time in the earnings call talking about the personalization opportunity. I'm not entirely sure I grasp why it's such a meaningful step forward, though, nor do I really understand why its current product offering isn't already personalized. Either way, per the shareholder letter, Hims & Hers is seeing 85% long term retention (defined as being a customer for over two years). That seems like really impressive performance in this D2C market.

Links:

- Hims & Hers Q4 & FY23 Shareholder Letter

- Hims & Hers Q4 2023 Earnings Transcript

- CNBC: Hims & Hers soars 31% on rapid growth in mental health, weight loss and dermatology treatments

Medicare Advantage model predicts a $33 nationwide PBPM reduction in benefits value in 2025

The Berkley Research Group released a whitepaper, sponsored by the Better Medicare Alliance, projecting that Medicare Advantage medical cost inflation will increase by 4% to 6% in 2025. This is higher than the 2.4% growth factor that CMS included in the 2025 Advance Notice. BRG forecasts this will result in a 1% drop in payments per beneficiary per month, and that plans will need to reduce the value to beneficiaries by $33 per month on average. As the chart above notes there is some massive variation, with Nevada in particular seeing a $90 PBPM drop. The paper does a nice job of explaining the broader macro dynamics driving the upcoming reduction in value for MA members.

Virta Health members see no regain in body weight following 12-months post de-prescription of GLP-1s

Virta Health, a virtual diabetes program, announced results from its recent peer-reviewed research study published in Diabetes Today, looking at outcomes of the company's approach to supporting users after the discontinuation of GLP-1 medications. The study demonstrated that Virta members who were de-prescribed from GLP-1 medication achieved sustained weight loss improvements, seeing no change or regain in body weight at a 12-month follow-up after stopping the use of the drug. These results seem like an exciting development if they hold considering the previously demonstrated concerns that many people who stop using GLP-1s experience quick weight regain and worsening blood sugar.

The outages associated with the Change Healthcare cyberattack are now into week two. UHG is preparing for this outage to go on for multiple weeks from here, according to STAT reporting on a discussion between UHG leaders and hospital cybersecurity officers. The ripple effects of this outage seem like they're just starting to appear, with national news reports that small and mid-sized practices that need timely reimbursement to stay afloat are potentially going to need to shut down. The AHA submitted a letter to the HHS Secretary asking for federal support for hospitals that are being impacted both by not being able to submit claims, and also not being able to complete eligibility checks. This is a massive issue for the entire industry, and coupled with the news immediately below it presents a real challenge for UHG to navigate.

Link / Slack (h/t David Kolacny Jr.)

UnitedHealth's rough week was compounded on Monday when The Examiner News reported that the DOJ launched an antitrust investigation into Optum in October 2023. As a brief aside, the Examiner News is a local news organization in New York that has done a thirteen part series about the issues about a local provider group called CareMont that Optum appears to have acquired back in 2022. It provides a fascinating local perspective on a provider acquisition. Back on the antitrust case, the WSJ picked up on the news Tuesday afternoon, and reported that investigators are in the early stages of an investigation and have been interviewing various industry representatives. Specifically, the DOJ appears to be asking about the relationship between UHC and Optum.

Link

R1 RCM received a buyout offer from private equity firm New Mountain Capital for $5.8 billion. New Mountain, which already owns ~33% of R1, has been in talks for at least a few weeks to buy out R1. The offer represented a 28% premium to R1's stock price prior to the news was made public. R1's stock is down ~40% from its previous twelve month high, prompting some analyst discussion about whether the buyout undervalues R1 RCM.

Link

Mississippi is one step closer to Medicaid expansion as a bill passed the Republican-led House and will now go to the Senate. Mississippi is one of ten remaining states that have not expanded Medicaid. If passed, it would give access to 210,000+ Mississippi residents access to Medicaid coverage.

Link / Slack (h/t Nikita Singareddy)

CVS and Walgreens are set to starting selling abortion pills in select stores across New York, Pennsylvania, Massachusetts, California and Illinois this month with the aim to expand access to care.

Link / Slack (h/t Evan Benkert)

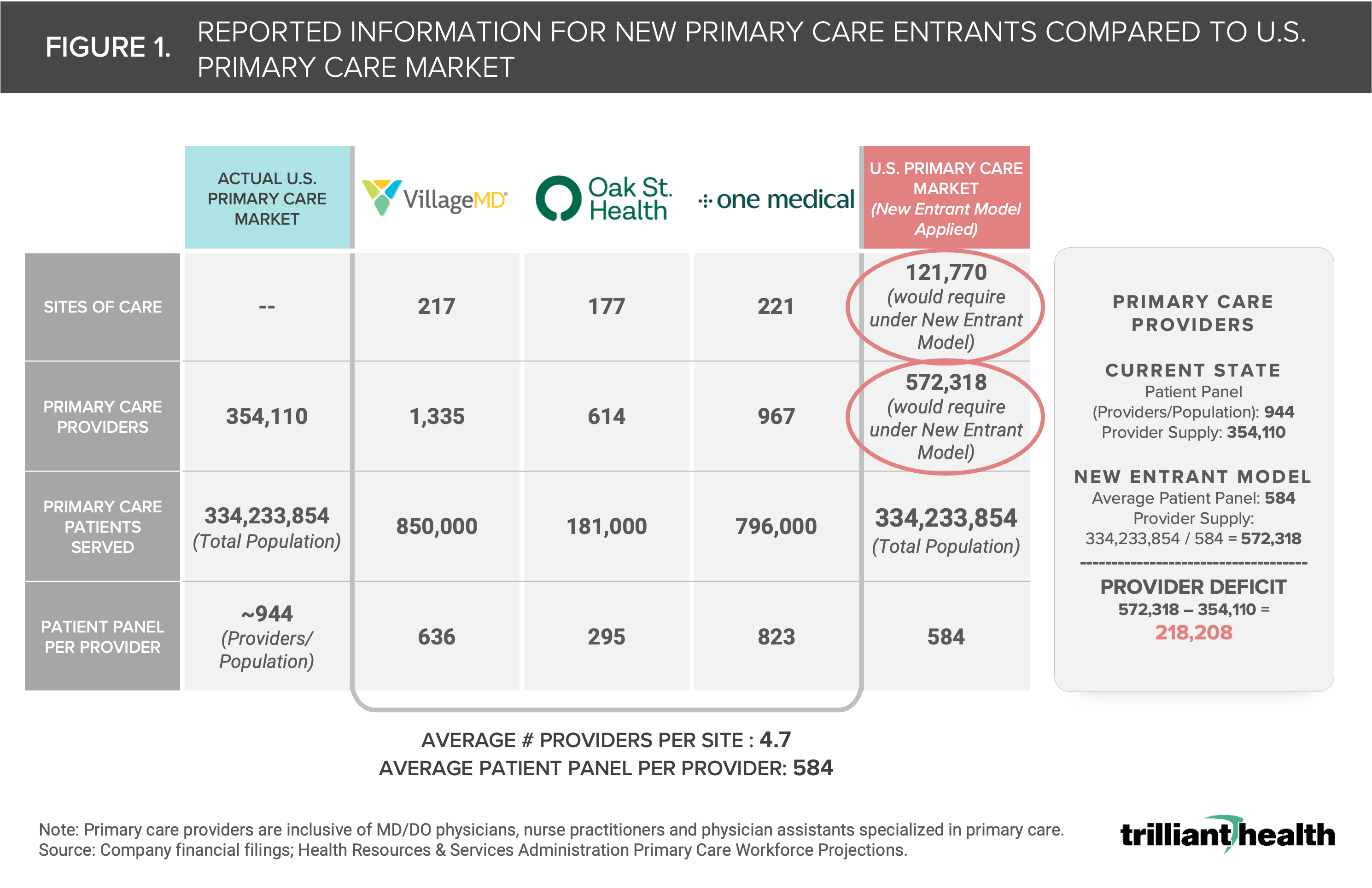

In additional Walgreens' news, the retail giant plans to close all of its VillageMD clinics in Illinois. The news comes just a week after the announcement of the company shutting down all VillageMD clinics in Florida and additional closures earlier this month in Massachusetts, Indiana, and New Hampshire.

Link / Slack (h/t Shannon Swaford)

Nuvance Health and Northwell Health announced a planned merger, which would create a 28-hospital health system including 14,500 providers. The deal would help New York-based Northwell expand into Connecticut.

Link / Slack (h/t Blake Madden)

WebMD announced its acquisition of the operating assets of Healthwise, a patient health education & engagement platform, These assets include content, products, tech, and client relationships.

Link / Slack (h/t David Cooper)

Veradigm, a healthcare data & analytics platform, announced its planned acquisition of ScienceIO, a healthcare AI startup, for $140 million in cash. The deal will allow Veradigm to leverage ScienceIO's proprietary AI models on Veradigm's data set, inclusive of 400,000 providers and 200 million+ patients.

Link / Slack (h/t Cole Roberts)

Reveleer, an AI-enabled data & analytics company, raised $65 million in funding. The startup providers a software platform that helps payors with several VBC-focused workflows, including risk adjustment, quality measurements, and member engagement.

Link

b.well, a FHIR-based data platform, raised $40 million in Series C funding.

Link / Slack (h/t David Kolacny Jr.)

Moxe Health, a healthcare data exchange platform, secured $25 million in growth capital to scale operations.

Link

Redi Health, a healthcare digital front door startup, raised $14 million in Series B funding to launch new products and accelerate growth.

Link

SalvoHealth, a GI enablement company, raised $5 million of fresh capital. The startup enables local physicians across the country to offer wraparound GI care via Salvo's telehealth and app-based support.

Link / Slack (h/t Michael Ceballos)

FamilyWell, a maternal mental health startup, secured $4.3 million in Seed funding. The company serves pregnant and postpartum patients access mental health services that are integrated with existing OB-GYN practices.

Link

Upheal secured $3.25 million in Seed financing. The startup is building a clinical workflow platform to support mental health providers.

Link / Slack (h/t Juraj Chrappa)

6 Ways Employers Can Prepare for their Expanded Role as Health Fiduciaries by Erica Everhart, JD, Blair Mohney, MBA, and Joe Mercado, MBA, MS

Recent legal changes to ERISA require self-funded employers to remove "gag-clauses" from contracts with TPAs, thus giving employers access to claims and pharmacy data needed to assess their employees' utilization of healthcare benefits. The move ultimately places additional legal and financial responsibilities on employers to ensure those benefits are being used wisely. The CareJourney teams offers 6 actions employers and TPAs can take to prepare for the future state.

Strategic Preparation 1: On Measurement by Andrew Schutzbank

In his new series on the topic of Strategic Preparation, Andrew explores the basics of measurement and covers how he has approached frameworks related to OKRs, performance evaluation, KPIs, health measures, and more.

The Alabama Pause by Neel Shah, MD

Following Alabama Supreme Court's recent decision to restrict IVF services across the state, Dr. Shah unpacks the history leading up to the ruling, the situation on the ground in Alabama, the politics driving these decision, and provides resources to several organizations on the frontlines tackling this issue (i.e. Yellowhammer Fund, Knights and Orchids Society, and West Alabama Women's Center).

Vice President of Partnerships at Third Way Health, an end-to-end front office platform. Link

VP, Care Marketplace at Headspace, a virtual mental health provider. Link

Market Enablement Manager at Oasis Health Partners, Inc., a value-based care company. Link

General Manager at TailorCare, an MSK platform. Link

Contact us to feature roles in our newsletter.

Welcome to Health Tech Nerds

Health Tech Nerds is one of the most trusted resources in healthcare, helping our members learn, network, build, and grow to maximize our collective impact on the healthcare system.

This week's newsletter sponsored by: Ambience Healthcare Ambience Healthcare’s AI operating system has been deployed at UCSF, Memorial Hermann Health System, John Muir Health, The Oncology Institute, and Eventus WholeHealth. By partnering with Ambience, health systems reduce documentation time by an average of 78%, improve coding integrity, and achieve at least a 5x ROI. Their suite of AI applications includes: AutoScribe: An AI medical scribe tuned by specialty, including the ED AutoCDI: A...

This week's newsletter sponsored by: Elation Health Elation Health, whose primary care EHR and billing solution supports companies including Crossover Health and Firefly Health, is committed to supporting and advancing the interests of primary care organizations. Recently, Elation was among the coalition of companies advocating for G2211, Medicare’s new billing code that ensures PCPs are adequately compensated for their investment in longitudinal care for patients. Elation’s commitment to...

This week's newsletter sponsored by: Medallion As care delivery organizations onboard new providers, many organizations must write off new provider revenue for over 60 days due to lengthy enrollment processes. Given providers average nearly $2,000 in revenue per day, that delay can equate to a loss of $120,000 per provider. With Medallion, this doesn’t have to be reality. In their on-demand webinar, credentialing experts from Medallion will share practical strategies for achieving “day one...